Getting My Home Renovation Loan To Work

Getting My Home Renovation Loan To Work

Blog Article

How Home Renovation Loan can Save You Time, Stress, and Money.

Table of ContentsAn Unbiased View of Home Renovation LoanThings about Home Renovation LoanFascination About Home Renovation LoanAn Unbiased View of Home Renovation LoanOur Home Renovation Loan Diaries

With the capability to deal with things up or make upgrades, homes that you may have previously passed over currently have potential. Some homes that need upgrades or improvements may also be readily available at a decreased cost when contrasted to move-in ready homes.This implies you can obtain the funds to buy the home and your prepared improvements done in one finance. This additionally aids you save money on closing prices that would certainly happen if you were securing an acquisition finance and a home equity funding for the repairs independently. Relying on what improvement program you pick, you might be able to increase your home worth and suppress allure from improvements while additionally constructing equity in your house.

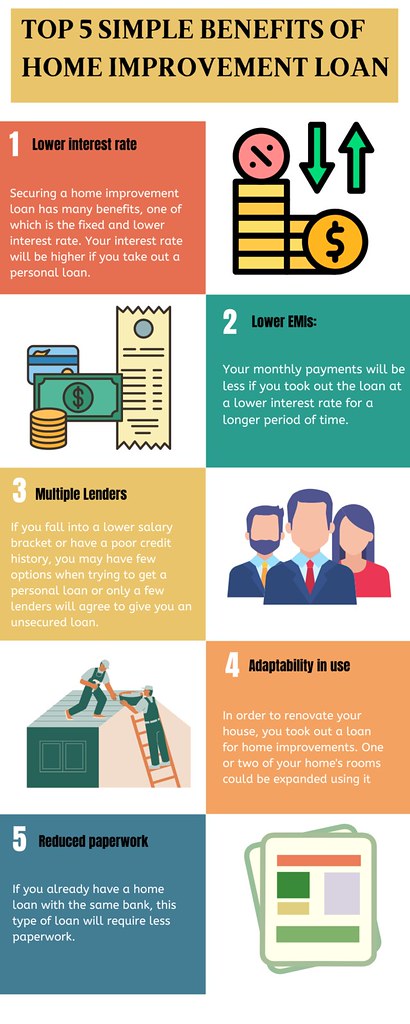

The rate of interest rates on home remodelling financings are typically less than personal lendings, and there will be an EIR, referred to as reliable rates of interest, for every single improvement loan you take, which is prices along with the base interest price, such as the administration charge that a bank might charge.

Home Renovation Loan Fundamentals Explained

If you have actually just got a minute: A restoration financing is a financing service that assists you far better manage your cashflow. Its reliable rates of interest is less than various other usual financing choices, such as charge card and individual car loan. Whether you have recently bought a new apartment or condo, making your home extra helpful for hybrid-work plans or making a nursery to invite a new child, restoration strategies could be on your mind and its time to make your strategies a truth.

A remodelling car loan is implied just for the funding of restorations of both brand-new and current homes. home renovation loan. After the loan is authorized, a taking care of charge of 2% of accepted finance amount and insurance coverage premium of 1% of authorized car loan quantity will be payable and subtracted from the authorized financing amount.

Adhering to that, the finance will be paid out to the professionals using Cashier's Order(s) (COs). While the maximum variety of COs to be issued is 4, any kind of additional carbon monoxide after the initial will sustain a charge of S$ 5 and it will certainly be deducted from your marked funding servicing account. Furthermore, fees would certainly also be incurred in the occasion of cancellation, pre-payment and late settlement with the fees displayed in the table listed below.

Getting The Home Renovation Loan To Work

Moreover, website gos to would be carried out after the dispensation of the lending to guarantee that the finance proceeds are utilized for the mentioned renovation works as listed in the quote. home renovation loan. Extremely commonly, restoration loans are compared to individual loans but there are some advantages to take out the former if you need a car loan particularly for home restorations

If a hybrid-work setup has now become an irreversible attribute, it might be great to consider refurbishing your home to produce a more work-friendly atmosphere, permitting you to have a designated job room. Again, an improvement finance can be a useful monetary device to plug your capital gap. Improvement financings do have a rather stringent use plan and it can only be used for renovations which are irreversible in nature.

If you find yourself still needing assistance to fund your home providing, you can occupy a DBS Personal lending or prepare yourself money with DBS Cashline to pay for them. One of the most significant false impressions concerning renovation car loan is the viewed high rate of interest as the published rate of interest is greater than individual financing.

8 Easy Facts About Home Renovation Loan Described

Furthermore, you stand to take pleasure in an extra eye-catching rates of interest when you make environmentally-conscious decisions with the DBS Eco-aware Renovation Funding. To certify, all you require to do is to meet any 6 out of the 10 items that are appropriate to you under the "Eco-aware Remodelling Checklist" in the application.

Or else, the steps are as follows. For Solitary Candidates (Online Application) Action 1 Prepare the needed papers for your restoration financing application: Checked/ Digital billing or quotation signed by service provider and candidate(s) Earnings Documents Proof of Ownership (Waived if improvement is for home under DBS/POSB Mortgage) HDB or MCST Remodelling Permit (for look at these guys applicants who are owners of the selected professional) Please keep in mind that each file dimension must not exceed 5MB and appropriate formats are PDF, JPG or JPEG.

10 Simple Techniques For Home Renovation Loan

Carrying out home renovations can have numerous positive effects. Getting the best home renovation can be done by utilizing one of the several home restoration loans that are available to Canadians.

They offer owners character homes that are central to regional features, use a worldwide design of life, and are typically in increasing markets. The downside is that a number of these homes require updating, occasionally to the entire home. To get those updates done, it requires financing. This can be a home equity funding, home line of credit report, home refinancing, or various other home money choices that can offer the cash needed for those revamps.

Often times, you can obtain whatever that you need without needing to move. click for more Home renovations are possible via a home renovation financing or one more line of debt. These type of finances can provide the homeowner the capacity to do a number of different points. A few of the important things feasible are terracing a sloped lawn, remodeling a visitor bedroom, changing an extra room right into an office, creating a basement, rental collection, or day home, and saving money on energy expenses.

Report this page